The HARVEST Agtech Innovation Accelerator Program recently delivered Masterclass 3, “Diversity in Agtech Funding,” bringing together leading investors, advisors, and industry experts to explore capital-raising strategies and the grower value proposition. Proudly supported by Grains Research & Development Corporation, Department of Primary Industries & Regional Development, Wheatbelt Development Commission, Wrays, and R&DIUM Capital, the session equipped founders with practical tools to navigate the complex funding landscape.

The day was structured around five key sessions, each unpacking a different aspect of raising and managing capital:

Pitching to different audiences – preparing for the Showcase

Tash opened with insights on how to shape a compelling pitch for different audiences. With the upcoming HARVEST Showcase on the horizon, participants were challenged to refine their stories, clearly articulate value, and keep the grower proposition at the core of their message.

Leveraging the R&D Tax Incentive – fuel for growth

Roy Smith, State Manager, R&DIUM Capital

Roy provided a deep dive into how founders can use the R&D Tax Incentive to extend their runway and de-risk their business for future investors.

Key takeaways from Roy included:

- “Have as many different capital levers you can pull as possible.”

- “Don’t be scared about claiming the R&D Tax Incentive – it’s there to support your R&D phase, commercialise your ideas, and ultimately create more jobs.”

- “Talk to your R&D Tax agent at least quarterly to avoid scrambling at year’s end – eligibility is best managed as you go.”

- “Put your R&D Tax Incentive details into your pitch decks – it’s a de-risker for VCs who don’t want to be the only money on the table.”

This session reinforced that strategic use of the R&D Tax Incentive not only boosts cash flow but also positions startups as credible, well-managed investment opportunities.

Industry Growth Program Overview

Greg Riebe, Industry Growth Program Adviser, Department of Industry, Science and Resources

Greg introduced the Industry Growth Program (IGP), a Federal Government initiative designed to accelerate the commercialisation of innovative businesses. The program provides tailored advisory services, expert mentoring, and matched grant funding to help startups and SMEs take their products to market faster and more effectively.

For agtech founders, the IGP represents an important lever alongside private investment – supporting ventures to refine their growth plans, validate markets, and secure the capital they need to scale.

What angel investors look for

Peter Toll, Partner, BDO Australia & Greg Riebe, Executive Director, Eir Corporate

The panel discussion with Peter and Greg shed light on how angel investors evaluate opportunities.

Greg emphasised that capital raising is a journey, not a one-time event:

- “Different people have different appetites and those appetites change along the journey… you are never raising money once, you are always raising money now.”

- “An investor is buying risk – they need to know how you’re going to best manage it.”

- “Get your mind in the head of the investor – think like a buyer, not a seller.”

Greg also highlighted that the expertise and connections provided by angel investors can often be just as valuable as the money itself.

Peter urged founders to be crystal clear about their funding asks:

- “Be clear on understanding your whole market dynamics and the whole environment your customers will operate in.”

- “Decide what you need, money, timeframe – and double it!”

- “When asking for money, be clear what the use is, where it’s going to go, and what the outcome will be.”

Greg reinforced the point: the investor lens is about risk, return, and signals. Every interaction, every piece of information shared contributes to due diligence. “When you approach an investor – everything is a signal.”

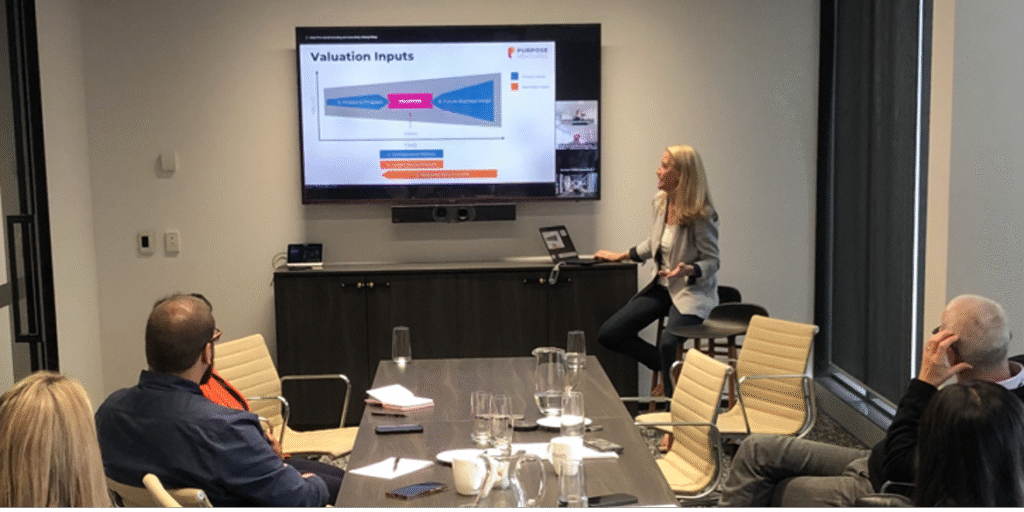

When to approach VCs and how they assess valuation

Kylie Gerrard, Co-Founder, Purpose Ventures

Kylie closed the day with a candid discussion about venture capital. She stressed the importance of timing, preparation, and transparency when engaging with VCs. With VCs, “due diligence is always on” – how founders present themselves and their business at every stage can impact outcomes.

The bigger picture – grants and strategy

Alongside capital raising, government grants were flagged as another vital funding lever. As DPIRD shared: “Get a really good grant application done and invest in a grant writer if writing is not your strength – future grants become considerably easier thanks to transferability.”

This mirrors the broader theme of the day: that securing capital is about more than money. It’s about building credibility, telling your story well, and demonstrating how your business reduces risk for those willing to back it.

Looking Ahead

Masterclass 3 underscored that successful agtech ventures need to master not just innovation, but also the art of financing growth. From pitching and grants to angels, VCs, and tax incentives, founders were encouraged to see funding as a toolkit – with multiple levers to pull along the journey.

With these insights, HARVEST participants are one step closer to showcasing their ventures, equipped with sharper pitches and stronger strategies to attract diverse investment.