Where investors, growers, and agtech ventures meet to accelerate innovation in agriculture

We are dedicated to driving innovation in the agricultural sector by connecting investors and growers with agtech ventures developing new technologies to improve productivity, sustainability, and resilience.

AgriSpace is an agtech investment syndicate facilitated through an intuitive online platform bringing together investors and growers with agtech venture businesses. The syndicate structure allows individual capital to be pooled together to invest in selected agtech ventures featured on the platform. Individuals can opt in or out of each deal and, due to the pooled nature, the minimum investment sizes are lower. Ventures are able to reach multiple investors through the platform and for an investment to appear as one line item on their cap table.

Creating flexible capital options to address the agtech funding gaps

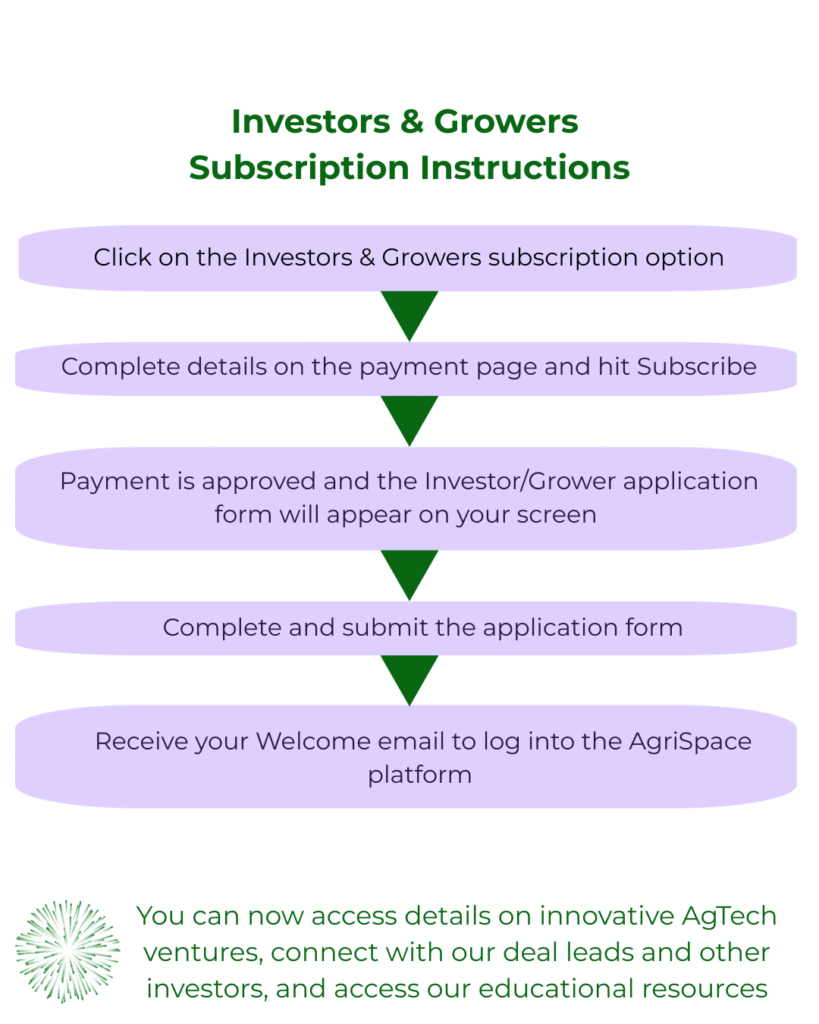

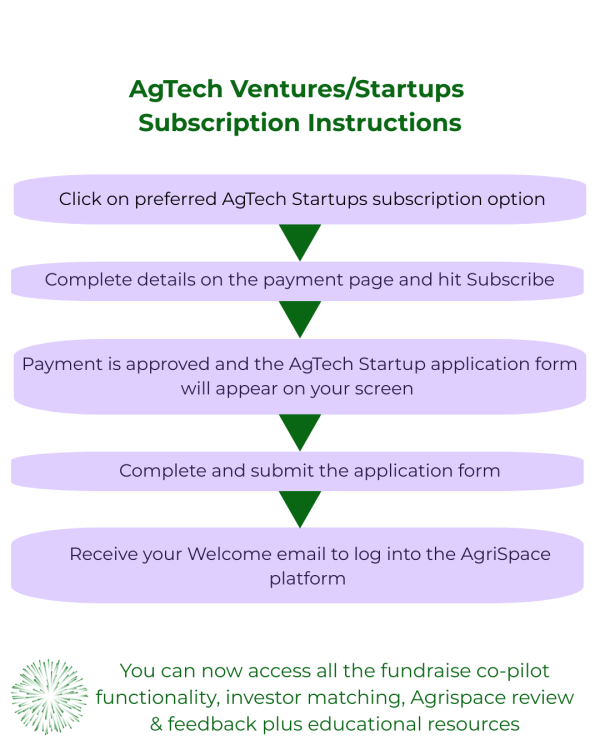

Member Subscriptions

Flexible subscription options, join today!

Buy a Subscription as a Gift

Click below to purchase and the gift voucher will be emailed to you to send to the lucky recipient. They can then click on the link in the voucher to join and access the platform.

Why Join?

Investors & Growers:

Early Access to Innovation – Connect directly with emerging Agtech ventures through providing feedback and potential trial partnerships

Lower Barriers to Entry – Funds are pooled therefore the minimum investment size for individuals can be lower (A$5k minimum) and you can opt in/out of each opportunity

Streamlined Admin – The backend is managed by a third-party investment group (GXE) with an AFSL licence who manages the investment process from end to end

- Expert Insights – Our experienced Investment Committee review each syndicate deal and share the deal notes as a starting point for your own due diligence

Support – Whether you’re new to angel investing or looking to diversify, we provide the resources, guidance, and networks you need

- Demo – online tutorial on how to use the platform most effectively

$99 per year access fee

Agtech Ventures:

Your Fundraise Co-pilot – Pitching, fundraising, and investor relations in one platform, offering tools for building pitch documents, managing a data room, communicating with investors plus investor matching capability

- Bridge the Funding Gap – We help you overcome the “valley of death” between bootstrapping (founder, friends & family) and later stage capital

Strategic Capital – Attract investors who have firsthand understanding of agriculture and may benefit from your innovation plus could provide valuable feedback or become trial partners and potential future customers

Streamlined Admin – One line on your cap table due to pooled investment and intuitive platforms

Mentorship & Support – Access a network of experienced industry advisors and structured mentorship programs to help your business grow

Expert Feedback – All ventures on the platform receive pitch feedback from our experienced Investment Committee

- Demo – online tutorial on how to use the platform most effectively

TEAM

Steph Kirchhofer

Manager

Dr Natasha Teakle

Investment Committee - Experienced Investor & Ag Expert

Matt Macfarlane

Investment Committee - Experienced Investor

Josh Garrett

Investment Committee - Experienced Investor

Sonya Comiskey

Investment Committee - Agtech/Venture Advisors

Amy Carter-James

Development Lead

FREQUENTLY ASKED QUESTIONS:

What is angel investing?

Is angel investing risky?

What is an angel investment syndicate?

Why Agtech?

How does the AgriSpace platform work?

What are the fees for investors?

What is the minimum investment amount?

Will an investment be automatically accepted?

Are there specific criteria investors need to meet to join AgriSpace?

What are the fees for agtech ventures?

What are the benefits of joining AgriSpace for an agtech venture?

Why is a syndicate structure helpful for a venture?

Who reviews the venture applications?

Is investment guaranteed for ventures?

What is the "valley of death"?

What is the time horizon for these investments?

Is there help to use the platform?

All information provided on this website is general and does not take into account your personal circumstances, financial situation, or needs. If you take action on the basis of the information provided on this website without first consulting a professional advisor, you do so entirely at your own risk. AgriSpace does not accept any liability for the results of any actions taken or not taken based on information in this site, or for any negligent misstatements, errors or omissions.